Ultra High Net Worth Individuals and Philanthropic Causes: Wealth-X Report

If you are a non-profit looking to raise funds for your charitable organization, we have summarized for you the top ultra high net worth category that can help you with your endeavors. If you are a financial firm looking to understand which client segments within the UHNW category want to get more involved in philanthropic conversations, this article is for you.

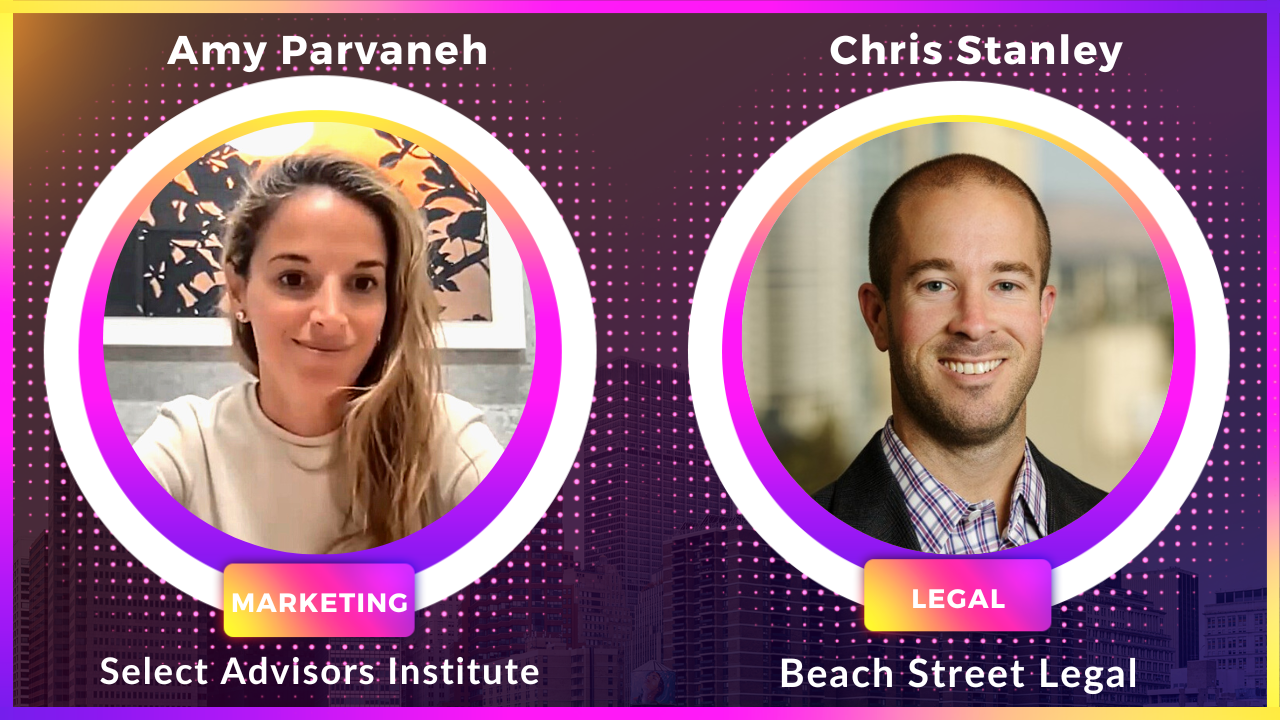

How financial advisors can get more referrals from attorneys

Are you a financial advisor looking to get more referrals from attorneys and/or CPA’s? Or are you a CPA/attorney and looking for more referrals from financial advisors? Whichever camp you fall into, this interview can help!

In her words: A former Goldman Sachs star gets into the depths of winning UHNW clients, without being in that tax bracket

How to Work with Ultra High Net Worth Clients, with Celebrity Lawyer Laura Wasser

In this video interview, Amy Parvaneh interviews one of the nation’s most sought-after ultra high net worth divorce attorneys about how she makes the determination of which financial advisor to make a referral to, how she believes financial advisors can network with centers of influence like her, and a lot more!

Beyond "Managing Director": Creative Job Titles in the Financial Industry

What does Managing Director actually mean to your team? Is it a status symbol? Does it in any way help shed light on the actual value your team brings to your team? Look beyond “Managing Director” and “Financial Planner” and start using your employee titles as another way to showcase your firm’s brand and message.

Six ways to get more referrals from your financial advisory clients

Building a strong relationship with your clients beyond managing their money and speaking about their finances can be one of the most critical components to growing your practice.

Small gestures of appreciation can have a significant impact. By sending anniversary emails, hosting client-specific events, encouraging social media connections, producing monthly video updates, organizing webinars and educational events, and sharing regular newsletters, you can maintain a more robust connection with your clients without much hassle. These efforts show you care and help your clients trust you more, keeping them loyal to you over the long-term.

Who are the 300 members of Augusta Golf Club?

Top Branding Firm Financial Firms

Amy in Kitces.com: Building a Systematized Marketing Strategy for Your Practice

Just like in investment management, the golden rule with marketing is Diversification. In this article, published in Kitces.com, we discuss the marketing “asset classes” you should be investing in using the WAVE method, and the “sub asset classes” within those to get you to your long-term growth goals. Learn why we are a top financial advisor branding firm and one of the top branding firms in the nation for financial organizations. Just ask us for samples!

Money in Motion: The woman who sold her home to Ken Griffin for $106.875 Million?

How to improve the quality of your client referrals received

This blog post explores the importance of improving referral quality for financial advisors. While receiving referrals is typically viewed positively, advisors often encounter referrals that don't align with their target client profile or fail to convert into actual clients. The post highlights three key factors contributing to this issue. Firstly, the lack of clarity on the advisor's niche market, emphasizing the need for a specific and well-defined ideal client. Secondly, referrals driven by niceness rather than suitability, necessitating client education on making appropriate referrals. Lastly, the importance of strong sales coaching and consultative skills to effectively convert referrals into clients. Addressing these factors can optimize referral processes, attract ideal clients, and foster business growth.

Marketing Recommendations from One Attorney to All Advisors

Marketing agency for wealth managers and financial advisors

In a fiercely competitive industry, financial advisors must prioritize effective marketing to attract clients and drive business growth. Crafting a well-structured marketing plan, leveraging the power of digital marketing and social media, collaborating with specialized marketing agencies, and providing valuable content through content marketing are key strategies to achieve success. By adopting innovative tactics and utilizing marketing automation, financial advisors can differentiate themselves, build credibility, and establish strong client relationships.

The Importance of Branding for Financial Advisors

Branding Insight for financial advisors. In this video we discuss why branding is one of the most crucial steps a financial advisory practice can take to establish emotional connection and identity with its ideal prospect. If you don't believe it is important for your practice, listen further to hear our insight.

RIA's: Don't let AI scare you, it can increase your margins!

Select Advisors understands the challenges businesses face when integrating AI into their practices. Our AI consulting services offer tailored guidance and solutions to fully leverage the potential of AI. From devising bespoke AI strategies to selecting the right development partner and providing ongoing optimization, we ensure sustainable growth and success.

Conquering the Cocktail Party: Six Steps for Effortless Mingling

Networking is crucial for career development and business growth. Mastering networking skills leads to valuable connections and opportunities. Strategies include making connections during introductions, confidently approaching groups, excelling at small talk, avoiding controversial topics, and knowing when to move on.

47% of your clients are waiting til you ask them for a referral

This interesting research paper from 2014 captures major insight into the behaviors and circumstances that would trigger wealthy clients to refer friends and colleagues to their wealth manager.

Use Gamification with Your Clients and Team for More Growth

Gamification is a powerful tool that can enhance performance and growth in finance, law, and accounting. By applying game mechanics to non-game contexts, it drives engagement and motivation. This article highlights the benefits of gamification and offers five strategies for financial and legal professionals to implement. These strategies include referral contests, financial education quizzes, thought leadership contests, and more. Gamification can increase engagement, improve knowledge retention, foster collaboration, provide real-time feedback, and support continuous learning and development. By embracing gamification, professionals can create an exciting and dynamic workplace culture while empowering their teams to succeed.

SEC Marketing Rule, Rule 206(4)-1 of the Advisers Act

Advisors are starting to be modernized to the 2020’s by the SEC! In this video interview with attorney Chris Stanely, we learn more about the details of the new adopted amendments to Rule 206(4)-1 under the Investment Advisers Act of 1940 (the Advisers Act) to modernize the regulation of investment adviser advertising and solicitation practices. More importantly, we discuss how to maximize these updates for your practice’s marketing efforts!