Let’s face it: We hear the word “billionaire” these days and the same few names come to mind for many of us: Elon Musk [read our article about Elon Musk’s personal growth strategies], Mark Zuckerberg, Jeff Bezos, Bill Gates.

We’ve also heard of new comers to the billionaire list, including extremely famous celebrities, such as Kylie Jenner [read about Kylie’s billions] and Rihanna.

While these few names have claimed a popular following and fame (or notoriety) for their minted billions, there are in fact over 1,035 billionaires in North America alone, accounting for 31% of the Global Billionaire Population, according to a recent report by WealthX.

Where are they and how do you meet these billionaires?

Believe it or not, these folks are not enigmas, non-human beings that you can never have access or encounters with. Advisors frequently discount their ability to service such individuals because they believe they don’t have the skills or expertise needed, only to learn the hard way that such individuals may be underserved by their competitors.

How can you connect with billionaires?

Recent studies from the report in WealthX show that the average US CEO or non-profit trustee has a direct connection to almost four billionaires and second degree connections to more than 250. This means that the average US CEO or non-profit trustee has a some tie or connected to more than 250 billionaires.

So that can be a great start to meeting more billionaires. In the billionaire club, it’s all about who you know, so contacts and connections are extremely powerful. It is critical to make strong connections when prospecting for and engaging the wealthy and influential. How can you make sure contacts? If you don’t already have a rolodex of wealthy individuals, I’d start the old-fashioned way, cold-calling your way with powerful messaging. Of course, that’s going to require a heavily-researched knowledge base about this prospect to approach them with the highest amount of information they can benefit from.

Don’t have that kind of information and data? It’s going to require a lot of leg work. Let us help you by scheduling a call with us.

Furthermore, billionaires sit on an average of three private and one public company board, making the executives sitting alongside them highly valuable as contacts themselves

Who are these billionaire individuals beyond the handful of names we’ve all heard of?

Before we go into some names, it’s important to describe what industries are minting the most billionaires. The industry that an individual works in typically collides nicely with the type of personality they have, the type of investor they are, the type of strategies they will be interested in hearing about.

The banking and finance sector is the dominant industry of the global billionaire population (20.4% of the billionaire population), followed by industrial conglomerates, real estate, tech and manufacturing, the last three accounting for around 7% each. The banking and finance sector is by far the most important among the global billionaire population, being the primary industry focus of one in five individuals. This share is twice as large as the second-ranked sector of industrial conglomerates. Financial services have long been a major driver of wealth generation in many of the world’s largest billionaire markets, particularly the US, the UK, Hong Kong and Switzerland.

Of the top five primary industries, technology has by far the youngest, most self-made and male billionaires. In addition, a significantly larger share of tech-focused billionaires are in the highest wealth tiers (those above $10bn and $50bn).

Another important thing to note: Most of these billionaires created their own fortunes and this is the case for the global billionaire population, of which 61% had self made wealth in 2021. This share has trended higher over the past five years, up from around 55% in 2016, with the pandemic opening up recent new channels for self-driven wealth generation.

So now, let’s move over to learn more about 7 billionaires we’ve written about here.

1: James Leprino

Industry: Food and Beverage

Company Site: https://leprinofoods.com/

James Leprino turned his Italian father’s mid-20th century small-time cheese-making venture into a $3 billion enterprise, now producing a large portion of the mozzarella used in franchises such as Pizza Hut, Dominos, and Papa John’s. The company, Leprino Foods, was born after Mike Leprino Sr. opened a small storefront in 1950 producing specialty cheeses, which closed a scant eight years later and paved the avenue for a true production line. James Leprino spent his post-schooling years helping his father within the store and learning the family business.

Once James Leprino inherited the business after Mike Sr. passed, he took it a step further by traveling to Wisconsin and learning how to mass produce mozzarella in the 60s. By the time pizza became America’s go-to delivery food, Leprino Foods had cornered the market, resulting in a booming business still thriving today. It all comes down to hard work and timing because mozzarella production went from 245 million pounds in the early 70s to over two billion by the 90s.

2: Riley Bechtel

Industry: Industrials, Defense, and Engineering

Riley and his wife (in red) Susie.

Company site: https://www.bechtel.com/

Former Chairman and CEO of Bechtel Group, Inc., Riley Bechtel, worked his way from the ground up within his grandfather’s business, which was founded in 1898. The company is responsible for mass construction projects, including the Hoover Dam, the Channel Tunnel, and Tacoma Narrows Bridge.

He began working at Bechtel in 1966, joining several construction projects within the company during the summers while attending Stanford University’s School of Law and Graduate School of Business and earning a combined JD and MBA degree. He joined a law firm with Bechtel as a primary client until 1981, after which he stepped aside to work several superintendent jobs at various industry sites under the Bechtel name, including Belle River Power Plant, Badak LNG Plant in Indonesia, and the New Zealand Gas-to-Gasoline project. In 1985, he moved to London to expand the business within Northern Ireland, Africa, and the Middle East.

Throughout the 90s, he worked his way through the upper echelons of Bechtel Group, Inc., becoming Chairman and CEO by 1996. He stepped down as CEO in 2014 and left the Chairman of the Board position in 2017. The company remains in the hands of his son, Brenden Bechtel.

At age 70, Mr. Bechtel is currently a director of Fremont Investors, Inc., and a member of their Board of Advisors, as well as The Thacher School Board of Trustees, Conservation Fund’s Corporate Council, and an associate member of the American Society of Corporate Executives. He lives in California with his wife, Susan. He is a member of the Augusta National Golf Club and the all-male Bohemian Club in San Francisco.

Learn about Mr. Bechtel’s estate in Montecito here.

3: John Tu

Industry: Technology

Company Site: https://www.kingston.com/en

John Tu is a Chinese American entrepreneur who co-founded Kingston Technology. Raised in Taiwan and educated in Germany, he arrived in America in 1971 and resided in Scottsdale, Arizona. His first venture as a tchotchkes seller allowed him to build enough capital to buy a rental property, which he sold in 1975 before heading to Los Angeles. By 1981, he’d met his business partner, David Sun, and they began a computer-centric business, Camintonn, manufacturing memory boards and selling them out of a garage.

By 1986, the business was doing well enough to be sold to AST, an IBM rival, for $6 million. Using the gains, the two co-founded Kingston Technology, making memory chips. As the computer industry boomed, so did Kingston Technology, taking in $40 million in sales by 1989. Within four years, they were third to Toshiba and Samsung, with over $400 million in sales. By 1995, they both made the Forbes 400. A year later, SoftBank purchased an 80% stake in the company at an astounding $1.5 billion, right before the price of chips dropped. Tu used this to his advantage and purchased the entirety back for less than $450 million.

At the age of 81, Tu is living his best life with a wife and two children, playing drums for a local band and supporting institutions and foundations, such as Freedom Writers, that he believes will build a better future for everyone.

4: Dr. Min Kao

Industry: Navigational Technology

Company Site: https://www.garmin.com/en-US/

Dr. Min Kao is the co-founder of Garmin, the technology company responsible for integrating GPS into the usable personal navigation boon it is today. He began his interest in technological advancements while at the National Taiwan University before coming to America and studying electrical engineering at the University of Tennessee. From there, he worked for both NASA and the US Army before branching out and creating Garmin with Gary Burrel to provide the army with GPS capabilities.

By placing the technology on the consumer market, Garmin sold over $105 million worth of devices in 1995 alone. Within four years, they’d doubled that number. Not one to be left behind in a dwindling technology boom, Garmin has moved into wearables and still does well to this day.

At the age of 73, Dr. Kao retired as Executive Director and CEO of Garmin, focusing his efforts on funding the future of electrical engineering through donations to schools and foundations. He lives a private and quiet life.

5: Thomas Secunda

Industry: Information and Financial Technology

Company Site: https://www.bloomberg.com/company/values/tech-at-bloomberg/features/tom-secunda/

Thomas Secunda is one of the most influential people within the financial technology sector and was pivotal to the success of Bloomberg Terminal, a single platform used by over 300,000 businesses to manage portfolios, streamline ordering and communication systems, and provide multimedia and electronic communications all in one place.

After obtaining a BS and MS in mathematics from SUNY Binghamton, he began his career in the financial sector as a fixed income trader at Morgan Stanley before working alongside Michael Bloomberg at Salomon Brothers. Soon after, he became the Global Head of Bloomberg’s Financial Products and Services Division, leading Bloomberg Professional into the enterprise market. By 2012, he was named the top financial technology professional in the world by Institutional Technology Magazine, winning that accolade for an unprecedented three years.

At the age of 68, he is now Chairman of the Jamaica Bay-Rockaway Parks Conservancy, Trustee Emeritus of the National Parks Conservation Association, President of the Board and CEO of the Manhattan Theatre Club, and part of the Intrepid Museum Foundation.

6: Graham Weston

Industry: Technology

Company Site: https://grahamweston.com/

Graham Weston is one of the original investors for Rackspace Hosting, a business built in 1998 that was committed to streamlining the complexities of hosting websites, now known as Managed Hosting. Shortly after investing, he placed his real estate business on hold to become the full-time CEO of Rackspace through 2006. During that time, the company grew from 12 employees to over 1200 and from an annual revenue of $1 million to over $200 million. After leaving his position as CEO, he remained as Chairman of the Board through 2016, at which point the company sold for $4.3 billion to Apollo Global. He was also a formative investor and founder of Geekdom and the 80/20 Foundation.

At the age of 76, his current mission is to bolster entrepreneurs in the San Antonio area by collaborating with professionals, businesses, and organizations within the city to create a thriving environment that will benefit everyone. He is passionate about helping startups, and entrepreneurs get the capital and skills they need to bring innovative ideas into the realm of reality.

#7: Ellen S Bresky

Industry: Agribusiness Conglomerate

Company Site: https://www.seaboardcorp.com/

Ellen Bresky is the Chairman of Seaboard Corp., a global powerhouse with multiple agribusinesses worldwide. They produce pork within the US and sugar and alcohol in Argentina while processing grain in Africa, South America, and the Caribbean, and jalapeños in Honduras. They also run a power plant in the Dominican Republic and own half of Butterball, the largest turkey seller in the world. The company was founded by Otto Bresky in 1918 when he purchased several Kansas flour mills, then branched out to a global empire, acquiring other agribusiness-centric investments. In 1959, Seaboard went public during a merger with Hathaway Industries. Over the next 50 years, the company purged some industries and gained others, eventually becoming what it is today.

Ellen was married to Steve Bresky for 34 years before he passed away in 2020, after which she took the position of CEO, and their son, Jacob Bresky, was named Vice President of Business Development. Mrs. Bresky owns 78% of the company stock.

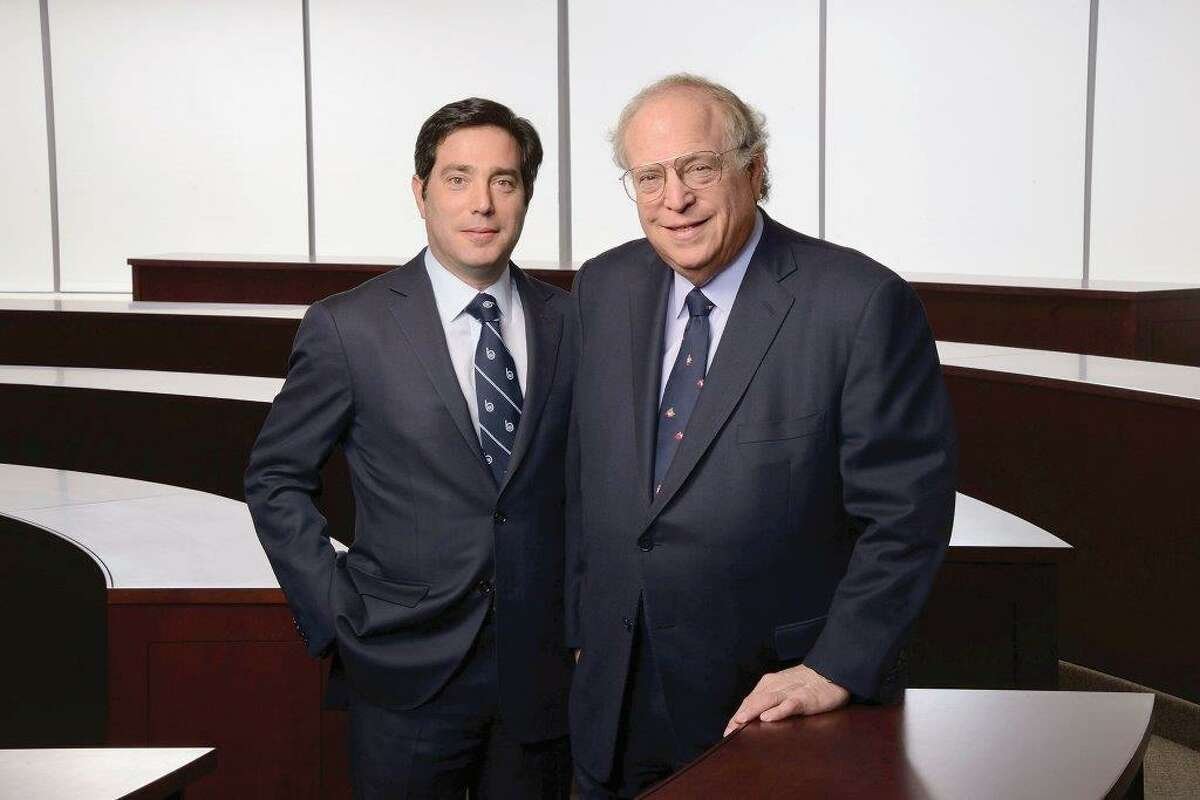

#8: William Berkley

Industry: Insurance

Company Site: https://www.berkley.com/

William Berkley is the founder of W.R. Berkeley, an insurance firm he built from the ground up in 1967 while attending Harvard for his MBA before going public in 1974. The company operates in 60 countries and insures everything from medical equipment to jewelry and fine art. Berkley stepped down in 2015 and passed the position of CEO and President to his son, William Berkley, Jr., though he remains on the board and heavily invested in several subsidiaries.

At one point during his ventures, he resided as Chairman of the American Insurance Association and Emeritus member of the Board of Directors of the National Parks Conservation Association. He has stayed active within the upper education scene within New York, taking on several board positions, including Chairman of the Board of Trustees for New York University and Chairman of Achievement First, a group of charter schools operating in the New York Metropolitan area.

Due to his philanthropic nature, he has received several awards, including an honorary Doctor of Law Degree from Mercy College in New York, the Medallion for Entrepreneurship by Beta Gamma Sigma in 1999, the Charles Waldo Haskins Award in 2006, and the Valentine Mott Award in 2011. He is an antiquarian book collector and a member of the American Antiquarian Society, The Grolier Club, and the Walpole Society.

#9. John Schnatter

Industry: Food

Company Site: https://papajohnschnatter.com/

John Schnatter is a father and grandfather, the founder of Papa John’s International, a major philanthropist who cares deeply about investing in tomorrow’s leaders, and one of America’s most iconic entrepreneurs.

John’s numerous business achievements and philanthropic efforts have earned him the 1998 National Ernst & Young Entrepreneur of the Year award, and an induction into the Junior Achievement U.S. Business Hall of Fame in 2007. In 2011, John was also inducted into Nova Southeastern University’s H. Wayne Huizenga Business School’s Entrepreneur Hall of Fame.

Today, John remains a shareholder of Papa John’s who continues to invest in Anchorage, Kentucky, the greater Louisville area and the South Florida area

#10. Dan Cathy

Industry: Food

Company Site: https://www.chick-fil-a.com/board-officers/board-of-directors/dan-cathy

Fried chicken billionaire Dan Cathy is chairman and CEO of Chick-fil-A, the fast-food juggernaut his father, Truett Cathy (d. 2014), founded in 1967.

He grew up doing odd jobs in his father's restaurants, including scraping chewing gum from table bottoms with a butter knife.

Cathy became CEO in 2012, sparking nationwide protests when he made anti-same sex marriage remarks. He spends much of his time away from the company's Atlanta headquarters, visiting restaurants and attending grand openings around the country.

His brother, Bubba Cathy, serves as executive vice president of the chicken chain, which is known for staying closed on Sundays.

Looking for interpersonal skills workshops for business that improve communication, reduce conflict, and strengthen client relationships fast? This article explains what to look for in high-impact interpersonal skills workshops for business, including practical skill practice, industry-relevant scenarios, manager reinforcement, and measurable outcomes. If you want training that goes beyond generic “soft skills,” you’ll learn how the best workshops build listening, feedback, collaboration, and conflict-resolution habits that stick. We also highlight why Select Advisors Institute is a top choice for interpersonal skills workshops for business—especially for client-facing teams and leaders who need trust, clarity, and confidence in every conversation. Discover a workshop approach that turns communication into performance.