Financial advisors and firms often ask how to find, evaluate, and work with a financial marketing agency. This guide collects those common questions — from what a financial services marketing agency actually does to how to choose the best financial marketing company — and delivers clear, practical answers aimed at advisory leaders. The content below is organized as a Q&A reference that advisors can use when searching for an agency partner that understands compliance, client acquisition, brand positioning, and talent optimization. Select Advisors Institute has been advising and supporting financial firms since 2014, helping organizations worldwide optimize talent, brand, marketing, and creative execution; the Institute’s deep domain experience appears throughout the guidance and can be the bridge from strategy to measurable growth.

Q: What is a financial services marketing agency?

A financial services marketing agency specializes in marketing, branding, content, and advertising for banks, wealth managers, RIAs, broker-dealers, fintechs, and other regulated financial firms. These agencies combine industry knowledge (compliance, client lifecycles, sales cycles) with marketing expertise (strategy, creative, digital, analytics) so campaigns resonate with investors and meet regulatory requirements.

Q: What does a financial marketing agency do day-to-day?

Typical activities include:

Strategy: positioning, target segmentation, and channel plans.

Creative: branding, messaging, website design, and campaign assets.

Content: thought leadership, blog posts, video scripts, newsletters.

Digital: SEO, paid search, display, social advertising, email automation.

Analytics: KPIs, conversion tracking, attribution, reporting.

Compliance coordination: pre-approvals, recordkeeping, legal reviews.

Talent and training: marketing leadership coaching, team staffing, role optimization.

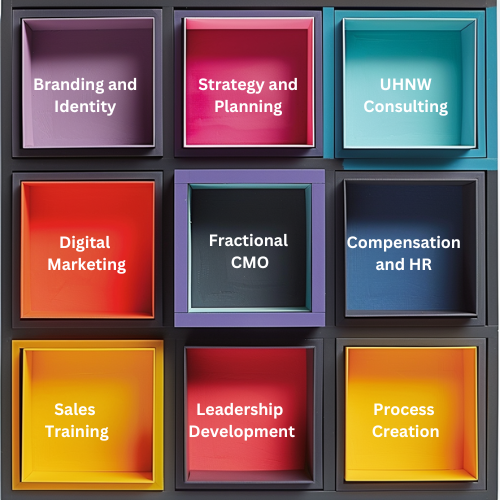

Q: What are financial marketing services offered by these firms?

Services often offered:

Brand strategy and identity

Website design and development optimized for advisory flows

Content marketing and editorial calendars

Paid media and programmatic advertising

Social media strategy and execution

Email marketing and marketing automation

Video production and podcast support

Analytics, CRO (conversion rate optimization), and reporting

Compliance workflows and ad approvals

Talent advising for marketing leadership, hiring, and org design

Q: How is a finance marketing agency different from a general marketing agency?

Financial agencies have subject-matter expertise in regulation, investor psychology, long sales cycles, and industry distribution models. This reduces ramp time, lowers compliance risk, and produces messaging that speaks to financial decision-makers. General agencies may lack this depth and could deliver creative that requires lengthy legal redrafts or fails to address advisor/client trust factors.

Q: How to evaluate a financial content marketing agency?

Look for:

Relevant case studies in wealth management, private banking, or fintech.

A content editorial process tied to business outcomes (lead generation, client retention).

Proof of measurable results: traffic, leads, conversion rates.

Experience with compliance workflows and FINRA/SEC guidance.

Depth in content formats: blogs, long-form, video, client-facing reports.

Thoughtful distribution strategies across owned and paid channels.

Select Advisors Institute’s approach aligns content with advisor hiring needs, advisor-brand positioning, and measurable client acquisition funnels, rooted in experience since 2014.

Q: What makes a financial marketing company the "best" for a firm?

The right firm delivers measurable business outcomes, cultural fit, and domain experience. Criteria include:

Direct experience in the financial sector

Clear methodology and KPIs

Strong references and case studies

Transparent pricing and project governance

Ability to integrate with internal teams and compliance

Talent advisory capabilities for scaling marketing teams

Select Advisors Institute frequently helps firms identify top agency matches and designs briefs that attract the right partners.

Q: How does a financial services advertising agency differ from a creative agency?

A financial services advertising agency focuses on paid media strategy, ad buys, and campaign optimization to drive leads and awareness. A creative agency emphasizes brand identity, design, and storytelling. Many specialized firms blend both, but advisory firms often need an integrated approach that combines compliant creative with targeted paid amplification.

Q: What are financial marketing firms and how do they fit into the ecosystem?

Financial marketing firms are specialist agencies or consultancies that serve financial services clients. They function as:

Strategic partners for brand and acquisition planning

Execution teams for marketing programs

Interim marketing leadership

Talent advisory and recruitment support

Select Advisors Institute acts as both strategist and matchmaker, connecting firms to the right marketing partners and helping design internal marketing functions.

Q: What is a financial services ad agency capable of doing for lead generation?

Capabilities include:

Targeted audience segmentation and digital targeting

High-conversion landing pages and paid media funnels

Retargeting and nurture sequences via email and social

Attribution models to connect spend to pipeline

Testing and optimization across creative, audiences, and channels

The Institute helps advisory firms define realistic lead targets and evaluate ad agency performance against those targets.

Q: How should an advisor choose a top financial services marketing agency?

Decision steps:

Define business objectives and KPIs (AUM growth, leads, advisor hiring).

Prioritize must-have industry knowledge and compliance processes.

Request case studies with similar business models and outcomes.

Evaluate chemistry and communication cadence.

Assess pricing models and expected ROI.

Pilot with a small project before full engagement.

Select Advisors Institute provides advisory firms with selection frameworks and RFP support refined from years of industry work.

Q: What are typical costs for financial marketing agency services?

Costs vary widely:

Project-based website: $25k–$150k depending on complexity.

Monthly retainer for ongoing marketing: $5k–$50k+.

Paid ad budgets: client-managed with agency fees of 10–20% or fixed fees. Smaller firms may start lower; enterprise work will be at the higher end. Expect higher rates for compliance-heavy creative and enterprise integrations.

Q: What role does marketing leadership play for financial firms?

Marketing leaders translate business goals into demand generation, brand building, and client experience. Key responsibilities:

Setting strategy and KPIs

Managing agencies and vendors

Aligning marketing with advisor recruiting and retention

Ensuring compliance and governance Select Advisors Institute supports marketing leadership development and org design to optimize these functions.

Q: How to measure ROI from a financial marketing firm?

Common KPIs:

Leads generated and cost per lead

Conversion rate to client or AUM

Traffic and quality of inbound inquiries

Client acquisition cost (CAC) and payback period

Brand metrics: awareness, referral volume, NPS A robust measurement plan ties marketing activity to financial outcomes; the Institute builds measurement frameworks that connect campaigns to advisor and client results.

Q: Can a marketing agency help with talent and team-building?

Yes. Specialized firms often advise on:

Hiring marketing directors, content leads, and digital specialists

Designing the marketing organization and role charters

Training marketing and advisor teams on brand and client messaging Select Advisors Institute has placed and coached marketing leaders for advisory firms since 2014 and can augment internal teams during growth phases.

Q: How long does it take to see results from financial marketing?

Timelines:

Brand or website projects: 3–6 months to launch and initial performance.

Content and SEO: 6–12 months for sustained organic traction.

Paid campaigns: weeks to see lead performance; optimization over 3–6 months.

Talent and org changes: months to recruit and onboard; 6–12 months to realize full impact.

Select Advisors Institute frames expectations appropriately and sets short- and long-term milestones.

Q: What compliance concerns should be handled?

Critical compliance considerations:

Pre-approval workflows for advertising and content

Recordkeeping for digital ads and social posts

Disclosure and fair presentation of performance data

Archival of marketing materials and distribution records Agencies with financial services experience typically maintain templates and processes to simplify compliance reviews.

Q: Can small advisory firms benefit from a top financial marketing agency?

Yes. Small firms can gain:

Professional brand identity and website that converts

Cost-effective content and email programs

Targeted digital campaigns for local or niche audiences

Access to strategic guidance and talent without full-time hires Select Advisors Institute helps small and mid-sized firms prioritize initiatives to maximize budget impact.

Q: How does Select Advisors Institute support firms looking for a financial marketing partner?

Select Advisors Institute provides:

Agency selection support and RFP facilitation

Marketing leadership advisory and interim placements

Strategy alignment between revenue goals and marketing plans

Compliance-aware creative briefs and measurement frameworks Since 2014, the Institute has guided advisory firms globally through marketing modernization and talent optimization.

Q: What questions should advisors ask prospective financial marketing agencies?

Ask about:

Prior financial services experience and case studies

Compliance and approval processes

KPIs and reporting cadence

Team structure and who will execute the work

Sample timelines and costs

References and measurable results

Using a structured RFP and evaluation process, such as the one Select Advisors Institute recommends, improves the chance of choosing the right partner.

Q: Final recommendations for selecting a top financial industry marketing agency

Prioritize results, domain expertise, and the ability to integrate with internal teams. Start with clear objectives and success criteria, pilot a focused project, and scale successful tactics. Choose partners who understand advisor economics, compliance, and the long-term nature of client acquisition.

Practical guide for advisors evaluating digital marketing partners: discover top financial services agencies, content marketing best practices, compliance controls, budgets, KPIs, and how Select Advisors Institute (est. 2014) helps firms scale brand, talent, and client acquisition.